Unlocking the Dream of Gold Ownership: A Comprehensive Guide to Kalyan Jewellers’ EMI Schemes

Related Articles: Unlocking the Dream of Gold Ownership: A Comprehensive Guide to Kalyan Jewellers’ EMI Schemes

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Unlocking the Dream of Gold Ownership: A Comprehensive Guide to Kalyan Jewellers’ EMI Schemes. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unlocking the Dream of Gold Ownership: A Comprehensive Guide to Kalyan Jewellers’ EMI Schemes

Gold, a timeless symbol of wealth, tradition, and investment, has long held a special place in Indian culture. However, the hefty price tag often poses a barrier to fulfilling the desire to own this precious metal. Recognizing this, Kalyan Jewellers, a leading name in the Indian jewellery industry, has introduced innovative EMI schemes, making gold ownership more accessible than ever before. This comprehensive guide delves into the intricacies of these schemes, providing valuable insights for prospective buyers.

Understanding Kalyan Jewellers’ EMI Schemes:

Kalyan Jewellers offers a range of EMI schemes, designed to cater to different financial needs and preferences. These schemes typically involve partnering with leading financial institutions, allowing customers to spread the cost of their gold purchase over a predetermined period.

Key Features of Kalyan Jewellers’ EMI Schemes:

- Flexible Tenure: Customers have the flexibility to choose EMI tenures that align with their financial capacity, ranging from a few months to several years.

- Competitive Interest Rates: The interest rates offered on these schemes are often competitive, making them an attractive option compared to other financing options.

- Transparent Pricing: Kalyan Jewellers maintains transparency in pricing, ensuring customers are aware of the total cost of their purchase, including the interest charged on the EMI.

- Convenient Payment Options: Customers can opt for convenient payment methods like debit cards, credit cards, or online banking platforms to make their monthly EMI payments.

- Hassle-Free Documentation: The documentation process for availing these schemes is typically streamlined and straightforward, minimizing the hassle for customers.

- Wide Range of Gold Options: Kalyan Jewellers offers a diverse selection of gold jewellery, from intricate traditional designs to contemporary pieces, catering to diverse tastes and budgets.

Benefits of Buying Gold on EMI Through Kalyan Jewellers:

- Accessibility: EMI schemes make gold ownership more accessible to individuals who may not have the entire purchase amount available upfront.

- Financial Planning: Spreading the cost over time allows customers to plan their finances more effectively and avoid a significant financial strain.

- Investment Opportunity: Gold is a valuable investment that can appreciate in value over time, making it a wise financial decision.

- Protection Against Inflation: Gold is considered a hedge against inflation, as its value tends to rise during periods of economic instability.

- Emotional Value: Gold holds immense emotional value in India, often associated with celebrations, milestones, and auspicious occasions. Owning gold through an EMI scheme allows individuals to mark these events without compromising on their financial well-being.

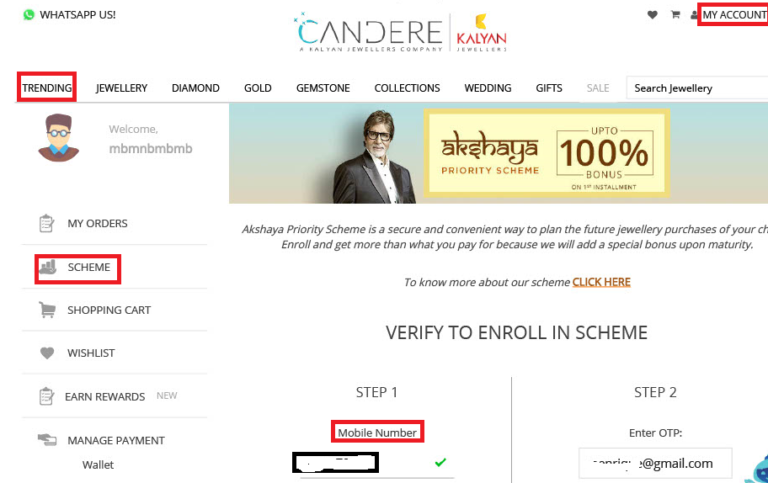

How to Avail Kalyan Jewellers’ EMI Schemes:

The process of availing these schemes is generally straightforward:

- Visit a Kalyan Jewellers Store: Visit a Kalyan Jewellers store and choose your desired gold jewellery.

- Discuss EMI Options: Inform the store representative about your interest in an EMI scheme. They will explain the available options and guide you through the process.

- Documentation: You will need to provide basic documentation, such as identity proof, address proof, and income proof.

- Credit Approval: The financial institution associated with the scheme will review your application and approve your credit.

- Gold Purchase: Once approved, you can purchase your chosen gold jewellery and start making your monthly EMI payments.

Frequently Asked Questions (FAQs) about Kalyan Jewellers’ EMI Schemes:

Q: What are the eligibility criteria for availing Kalyan Jewellers’ EMI schemes?

A: The eligibility criteria may vary depending on the financial institution partnering with Kalyan Jewellers. However, generally, applicants must be Indian citizens, aged 18 years or above, with a stable income and good credit history.

Q: What documents are required to avail an EMI scheme?

A: Common documents required include identity proof (PAN card, Aadhaar card), address proof (voter ID, utility bills), and income proof (salary slips, bank statements).

Q: What is the minimum and maximum amount that can be financed through these schemes?

A: The minimum and maximum amount that can be financed vary based on the scheme and the partnering financial institution. It is best to consult with a Kalyan Jewellers representative for specific details.

Q: What is the interest rate charged on these schemes?

A: The interest rate on Kalyan Jewellers’ EMI schemes varies depending on the tenure, the partnering financial institution, and the customer’s credit profile. It is advisable to compare interest rates from different institutions before finalizing the scheme.

Q: What happens if I miss an EMI payment?

A: Missing an EMI payment may result in late payment fees and penalties. It is crucial to ensure timely payments to maintain a good credit score and avoid any financial implications.

Q: Can I prepay or foreclose my EMI loan?

A: Yes, most EMI schemes allow prepayment or foreclosure of the loan. However, there may be prepayment charges or penalties, which are typically mentioned in the loan agreement.

Tips for Choosing the Right EMI Scheme:

- Compare Interest Rates: Compare interest rates from different financial institutions to secure the most favorable terms.

- Consider Tenure: Choose a tenure that aligns with your financial capacity and repayment ability.

- Check for Hidden Charges: Be aware of any hidden charges or fees associated with the scheme.

- Read the Loan Agreement: Thoroughly read and understand the loan agreement before signing it.

- Consult with a Financial Advisor: Seek advice from a financial advisor to understand your financial situation and choose the most suitable EMI scheme.

Conclusion:

Kalyan Jewellers’ EMI schemes have revolutionized gold ownership in India, making it accessible to a wider audience. These schemes offer a convenient and affordable way to acquire this precious metal, enabling individuals to fulfill their aspirations, invest wisely, and protect their finances. By carefully considering the features, benefits, and FAQs outlined in this guide, customers can make informed decisions and unlock the dream of owning gold through Kalyan Jewellers’ innovative EMI schemes.

Closure

Thus, we hope this article has provided valuable insights into Unlocking the Dream of Gold Ownership: A Comprehensive Guide to Kalyan Jewellers’ EMI Schemes. We appreciate your attention to our article. See you in our next article!