The Ultimate Guide to Investment Jewelry: A Comprehensive Look at Precious Metals and Gemstones

Related Articles: The Ultimate Guide to Investment Jewelry: A Comprehensive Look at Precious Metals and Gemstones

Introduction

With great pleasure, we will explore the intriguing topic related to The Ultimate Guide to Investment Jewelry: A Comprehensive Look at Precious Metals and Gemstones. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Ultimate Guide to Investment Jewelry: A Comprehensive Look at Precious Metals and Gemstones

Jewelry, often seen as an expression of personal style and sentiment, can also be a valuable investment. While fashion trends ebb and flow, the inherent beauty and enduring value of certain jewelry pieces can appreciate over time, making them a compelling addition to any diversified portfolio.

This comprehensive guide explores the world of investment jewelry, delving into the factors that drive value, highlighting specific pieces to consider, and providing insights into the intricacies of this unique asset class.

Understanding the Value Drivers of Investment Jewelry

The intrinsic value of jewelry lies in the materials used: precious metals and gemstones. These materials are inherently scarce and have a long history of being prized for their beauty and durability.

-

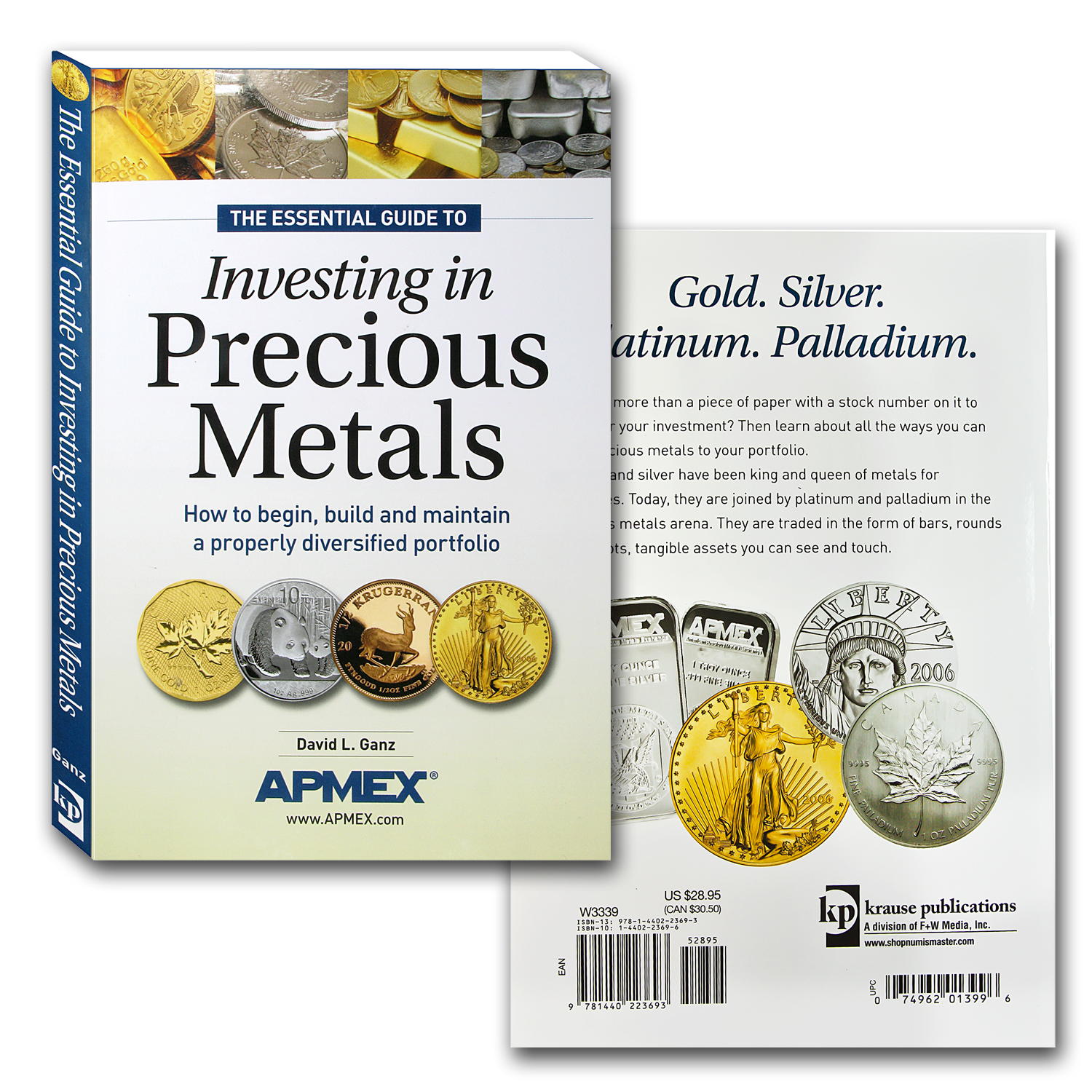

Precious Metals: Gold, silver, platinum, and palladium are the most common precious metals used in jewelry. Their value fluctuates based on global economic factors, supply and demand, and geopolitical events.

-

Gemstones: Diamonds, rubies, sapphires, emeralds, and other gemstones are valued for their rarity, color, clarity, and cut. Their value is influenced by factors like origin, size, and quality.

Factors Influencing Jewelry Investment Value:

- Rarity: Limited availability of specific gemstones or unique designs increases their value.

- Provenance: A piece with a known history or association with a notable person can command a premium.

- Condition: Excellent condition, free from damage, enhances the value.

- Demand: Current fashion trends and cultural preferences influence demand and therefore value.

- Brand Recognition: Reputable jewelers and designers often add value to pieces.

- Investment Grade: Jewelry specifically designed for investment purposes often features higher quality materials and craftsmanship.

Best Investment Jewelry Pieces:

1. Diamonds:

- Classic Solitaires: Round brilliant cut diamonds in solitaire settings are timeless and universally appealing.

- Fancy-Cut Diamonds: Princess, emerald, and pear-shaped diamonds offer unique aesthetics and can be more valuable than round brilliant cuts.

- Colorless Diamonds: Diamonds with a D-F color grade are considered most valuable.

- High Clarity: Diamonds with VS1 or VS2 clarity grades are generally preferred for investment.

- Large Carat Weight: Diamonds weighing over one carat are more valuable due to their rarity.

2. Colored Gemstones:

- Rubies: Red rubies from Burma (Myanmar) are highly prized.

- Sapphires: Blue sapphires from Kashmir are considered among the most valuable.

- Emeralds: Colombian emeralds are known for their vibrant green hues.

- Fancy-Colored Diamonds: Pink, yellow, and blue diamonds are rare and highly sought after.

3. Precious Metals:

- Gold: Gold bars and coins are considered safe-haven assets and can offer diversification in a portfolio.

- Platinum: Platinum is more rare and durable than gold, making it a valuable investment.

- Palladium: Palladium is used in automotive catalytic converters and is increasingly in demand.

4. Vintage and Antique Jewelry:

- Art Deco: Jewelry from the 1920s and 1930s, characterized by geometric patterns and geometric designs, can be a valuable investment.

- Victorian Era: Victorian jewelry, known for its intricate details and use of precious metals, is often sought after by collectors.

- Estate Jewelry: Pre-owned jewelry from reputable sources can offer significant value, especially if it features high-quality materials and craftsmanship.

Investing in Jewelry: Key Considerations:

- Research: Thorough research is crucial to understand the market value of specific pieces.

- Authenticity: Ensure the jewelry is genuine and comes with a certificate of authenticity.

- Valuation: Have the jewelry professionally appraised to determine its current market value.

- Storage: Proper storage and care are essential to preserve the condition of the jewelry.

- Insurance: Insure the jewelry to protect against loss or damage.

- Liquidity: Jewelry can be difficult to sell quickly, so consider liquidity needs.

FAQs about Investment Jewelry:

Q: Is jewelry a good investment?

A: Jewelry can be a good investment if you choose pieces with intrinsic value, understand the market dynamics, and manage your expectations. However, it is not a guaranteed return and can be subject to fluctuations in value.

Q: What type of jewelry is best for investment?

A: Investment-grade jewelry typically features high-quality materials, craftsmanship, and design that appeals to a broad market. Diamonds, colored gemstones, and precious metals are popular choices.

Q: How do I know if a piece of jewelry is worth investing in?

A: Consult with a reputable jeweler or appraiser to assess the piece’s authenticity, condition, and market value. Look for certificates of authenticity, grading reports, and historical documentation.

Q: What are the risks associated with investing in jewelry?

A: Jewelry investments are subject to market volatility, fluctuations in demand, and potential for loss due to damage or theft. It’s essential to diversify your portfolio and understand the risks involved.

Q: How do I sell investment jewelry?

A: You can sell investment jewelry through reputable jewelers, auction houses, or online platforms.

Tips for Investing in Jewelry:

- Start Small: Begin with affordable pieces to gain experience before investing in more expensive items.

- Diversify: Don’t put all your investment eggs in one basket. Diversify your jewelry portfolio across different types of pieces.

- Follow Trends: Stay informed about current fashion trends and market dynamics.

- Seek Professional Advice: Consult with a financial advisor or jewelry expert for personalized guidance.

Conclusion:

Investing in jewelry can be a rewarding experience, offering potential for appreciation and diversification in a portfolio. However, it requires careful consideration, research, and a deep understanding of the market. By choosing pieces with intrinsic value, carefully managing risk, and staying informed about market trends, you can make informed investment decisions and potentially build a valuable collection. Remember, jewelry is not just about beauty and adornment; it can be a tangible asset with the potential to appreciate over time.

Closure

Thus, we hope this article has provided valuable insights into The Ultimate Guide to Investment Jewelry: A Comprehensive Look at Precious Metals and Gemstones. We appreciate your attention to our article. See you in our next article!