Streamlining Success: The Power of Accounting Add-ons for the Jewelry Industry

Related Articles: Streamlining Success: The Power of Accounting Add-ons for the Jewelry Industry

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Streamlining Success: The Power of Accounting Add-ons for the Jewelry Industry. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Streamlining Success: The Power of Accounting Add-ons for the Jewelry Industry

In the glittering world of jewelry, where artistry and precision converge, meticulous financial management is paramount. Beyond the allure of precious gems and elegant designs lies a complex web of inventory, sales, and operational processes that require robust accounting solutions. Enter accounting add-ons, specialized tools designed to enhance the capabilities of accounting software and streamline the financial operations of jewelry businesses.

Navigating the Complexities of the Jewelry Industry

The jewelry industry presents unique challenges for accounting, demanding solutions that cater to its specific needs. These challenges include:

- Inventory Management: Tracking a diverse range of precious metals, gemstones, and finished products, each with varying values and intricate details, requires a highly sophisticated inventory management system.

- Pricing and Valuation: Determining accurate pricing for jewelry pieces, considering fluctuating market prices of precious metals and gemstones, requires specialized valuation tools and knowledge.

- Sales and Marketing: Capturing detailed sales data, managing customer relationships, and analyzing marketing campaigns are essential for driving sales and maximizing profitability.

- Compliance and Regulations: The jewelry industry is subject to stringent regulations, including tax requirements, import/export controls, and ethical sourcing guidelines, necessitating compliance features within accounting systems.

The Rise of Accounting Add-ons: Empowering Efficiency

Accounting add-ons address these challenges by providing specialized functionalities that integrate seamlessly with existing accounting software. These add-ons empower jewelry businesses to:

- Optimize Inventory Management: Track inventory levels, manage stock movements, and automate purchase orders with greater precision.

- Streamline Pricing and Valuation: Calculate accurate pricing based on fluctuating market values, manage inventory costs, and generate comprehensive reports.

- Enhance Sales and Marketing: Capture detailed customer information, analyze sales trends, and track marketing campaign performance to optimize sales strategies.

- Ensure Compliance and Regulatory Adherence: Manage tax obligations, track import/export activities, and comply with ethical sourcing standards with ease.

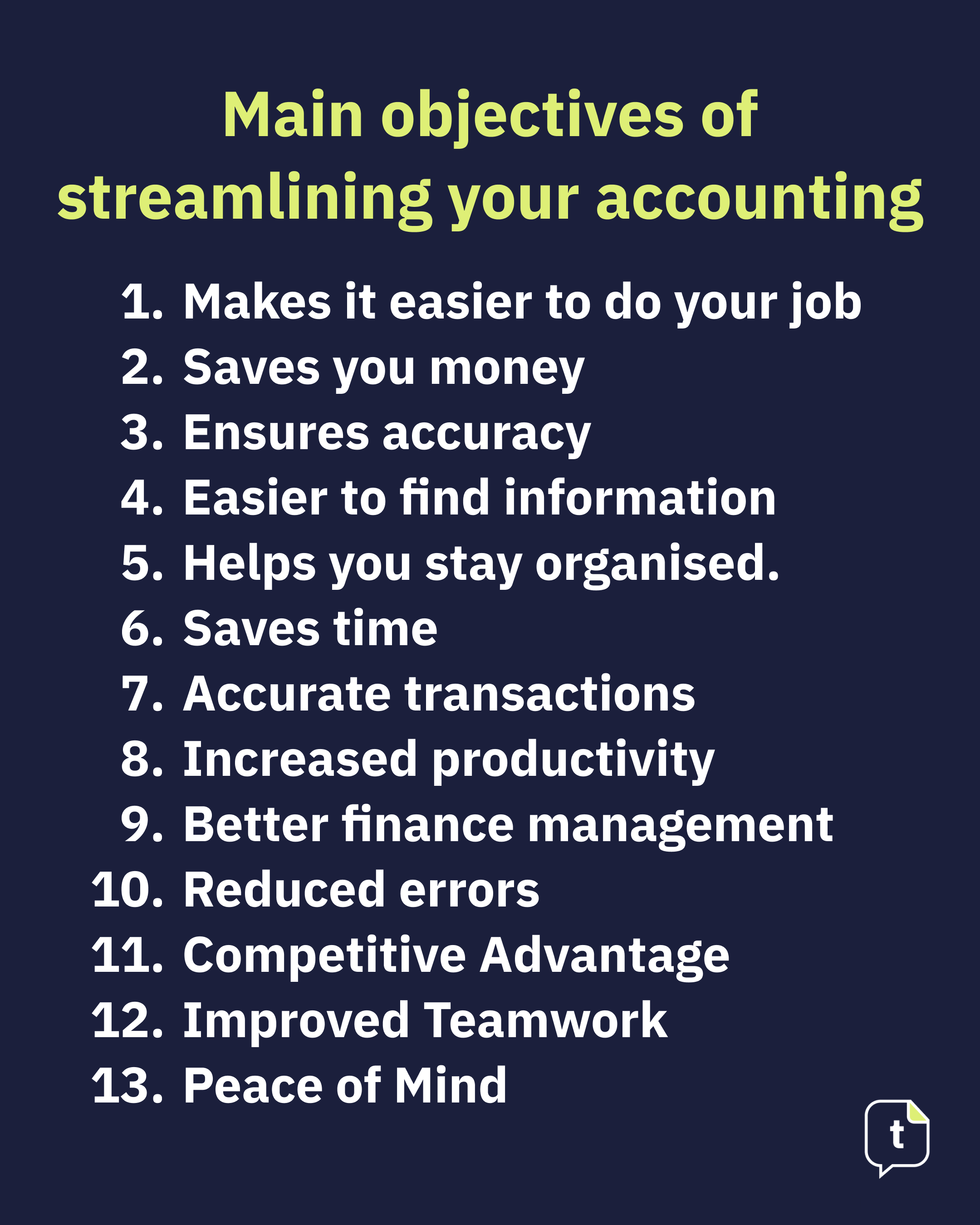

Key Benefits of Accounting Add-ons for Jewelry Businesses:

- Increased Efficiency: Automate repetitive tasks, streamline workflows, and eliminate manual errors, freeing up time for strategic decision-making.

- Improved Accuracy: Minimize human error with automated calculations, data entry, and inventory tracking, ensuring accurate financial reporting.

- Enhanced Visibility: Gain real-time insights into inventory levels, sales performance, and financial health, enabling informed decision-making.

- Reduced Costs: Optimize inventory management, minimize waste, and streamline operations, leading to cost savings and improved profitability.

- Enhanced Customer Satisfaction: Provide efficient and accurate service, track customer preferences, and personalize experiences for increased loyalty.

Exploring Popular Accounting Add-ons for the Jewelry Industry:

- Inventory Management Add-ons: These add-ons offer comprehensive inventory tracking, barcode scanning, automated purchase orders, and detailed reporting, ensuring efficient stock management.

- Valuation and Pricing Add-ons: These tools provide real-time market data, automated pricing calculations, and gemstone valuation services, enabling accurate pricing and cost control.

- Sales and Marketing Add-ons: These add-ons integrate CRM functionality, capture customer data, analyze sales trends, and track marketing campaign performance, optimizing sales strategies.

- Compliance and Reporting Add-ons: These solutions ensure compliance with tax regulations, import/export requirements, and ethical sourcing guidelines, providing comprehensive reporting and audit trail capabilities.

Frequently Asked Questions (FAQs)

1. What are the key considerations when choosing an accounting add-on?

- Compatibility: Ensure the add-on is compatible with your existing accounting software.

- Functionality: Select an add-on that addresses your specific needs and provides the required functionalities.

- Ease of Use: Choose an add-on with a user-friendly interface and intuitive navigation.

- Cost: Consider the cost of the add-on and compare it with the potential benefits and savings.

- Support: Ensure the vendor provides reliable customer support and technical assistance.

2. How can I integrate an accounting add-on with my existing software?

Most accounting add-ons offer seamless integration with popular accounting software through APIs (Application Programming Interfaces). The integration process typically involves connecting your accounting software to the add-on through a secure connection, allowing data to be shared between the systems.

3. What are the potential risks associated with using accounting add-ons?

- Security: Ensure the add-on provider adheres to industry-standard security measures to protect your sensitive data.

- Compatibility Issues: Ensure compatibility with your existing software and operating system.

- Vendor Support: Choose a vendor with a proven track record of reliable customer support and technical assistance.

- Cost: Consider the cost of the add-on and its potential return on investment.

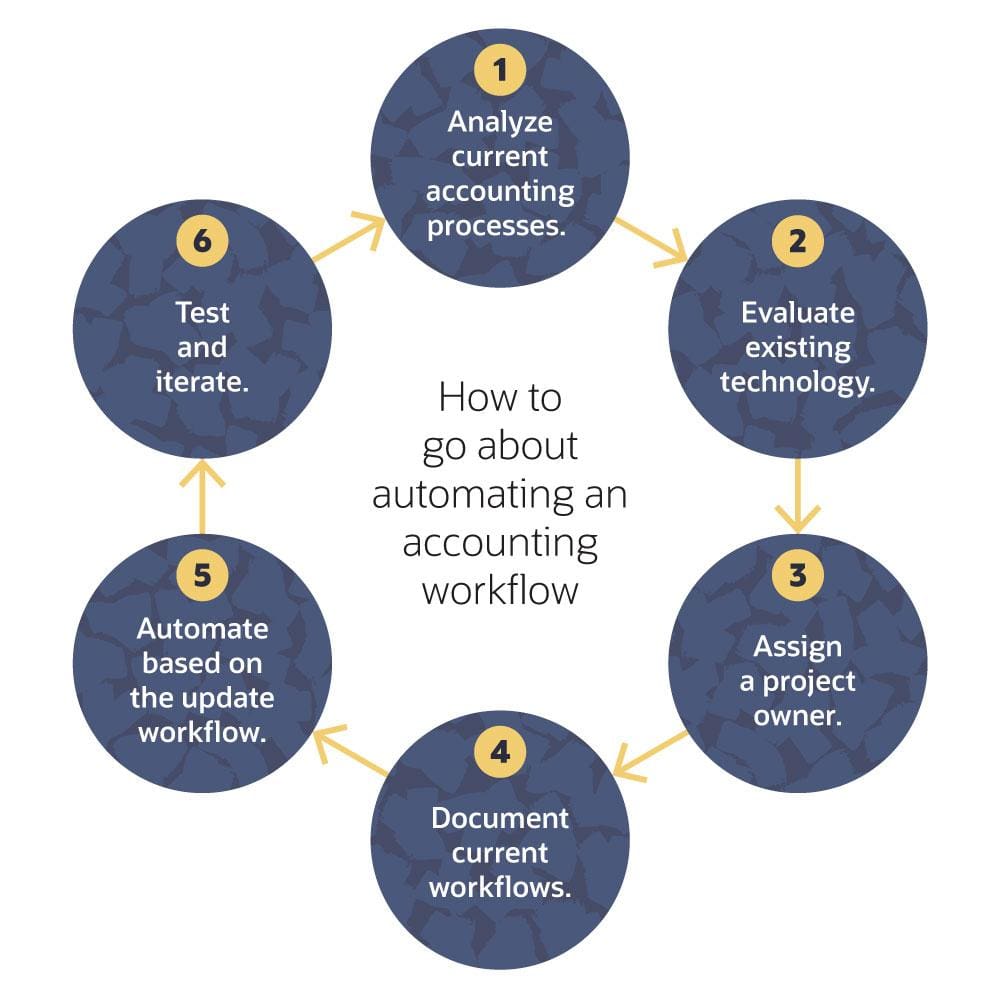

Tips for Successful Implementation of Accounting Add-ons:

- Define Your Needs: Clearly identify your specific accounting challenges and the functionalities you need.

- Research and Compare: Thoroughly research different add-ons and compare their features, pricing, and user reviews.

- Seek Expert Advice: Consult with an accounting professional or IT specialist to ensure the add-on is suitable for your business.

- Pilot Test: Implement the add-on on a small scale before full deployment to identify potential issues and refine workflows.

- Provide Training: Train your staff on how to use the add-on effectively to maximize its benefits.

Conclusion

In the competitive landscape of the jewelry industry, accounting add-ons are no longer a luxury but a necessity. By leveraging the power of these specialized tools, jewelry businesses can streamline their financial operations, optimize inventory management, enhance sales strategies, and ensure regulatory compliance, setting the stage for sustainable growth and success. Embracing the efficiency and insights offered by accounting add-ons empowers jewelry businesses to focus on what matters most: creating exquisite designs and building lasting customer relationships.

Closure

Thus, we hope this article has provided valuable insights into Streamlining Success: The Power of Accounting Add-ons for the Jewelry Industry. We hope you find this article informative and beneficial. See you in our next article!