Safeguarding Your Sparkle: A Guide to the Best Jewelry Insurance Companies

Related Articles: Safeguarding Your Sparkle: A Guide to the Best Jewelry Insurance Companies

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Safeguarding Your Sparkle: A Guide to the Best Jewelry Insurance Companies. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Safeguarding Your Sparkle: A Guide to the Best Jewelry Insurance Companies

Jewelry, with its inherent beauty and sentimental value, often represents more than just a material possession. It can embody memories, milestones, and personal style. Protecting this precious investment is paramount, and jewelry insurance serves as a vital safety net against unforeseen circumstances. This comprehensive guide explores the landscape of jewelry insurance companies, providing insights into their offerings, factors to consider when choosing a provider, and essential tips for safeguarding your treasured pieces.

Understanding the Importance of Jewelry Insurance

Jewelry insurance is a specialized type of coverage designed to protect your valuables against a range of perils, including:

- Theft: Whether it’s a home burglary, a snatch-and-grab incident, or a loss while traveling, jewelry insurance provides financial compensation for stolen items.

- Damage: Accidents happen, and jewelry is susceptible to damage from falls, scratches, spills, or even natural disasters. Insurance can cover repair or replacement costs.

- Loss: Losing a ring, necklace, or bracelet can be devastating, especially if it holds sentimental value. Jewelry insurance can help replace or compensate for the loss.

Key Considerations When Choosing a Jewelry Insurance Provider

Navigating the world of jewelry insurance can be overwhelming. Here’s a breakdown of essential factors to consider when selecting a provider:

-

Coverage Options: Ensure the provider offers comprehensive coverage for your specific needs. This includes coverage for:

- All-risk: Covers loss or damage from any cause, except for exclusions like wear and tear.

- Named perils: Covers loss or damage only from specific perils listed in the policy, such as theft or fire.

- Specific perils: Offers coverage for a limited range of perils, typically theft and accidental damage.

-

Valuation Method: The value of your jewelry determines the premium and potential payout. Providers use different methods for valuation, including:

- Appraisal: A professional appraisal by a certified gemologist provides an objective assessment of the jewelry’s value.

- Receipt: A sales receipt can serve as evidence of purchase price, though it may not reflect current market value.

- Agreed value: This option allows you to set a specific value for your jewelry, which can be advantageous for heirloom pieces or those with fluctuating market prices.

- Deductible: This is the amount you pay out-of-pocket before the insurance kicks in. A higher deductible generally means lower premiums.

- Premium: The cost of insurance depends on the value of your jewelry, coverage options, and deductible. Compare premiums from different providers to find the best value for your needs.

- Claims Process: A smooth and efficient claims process is crucial in case of a loss or damage. Research the provider’s claims history and customer satisfaction ratings.

- Reputation and Financial Stability: Choose a reputable and financially sound insurance provider with a track record of paying claims promptly and fairly.

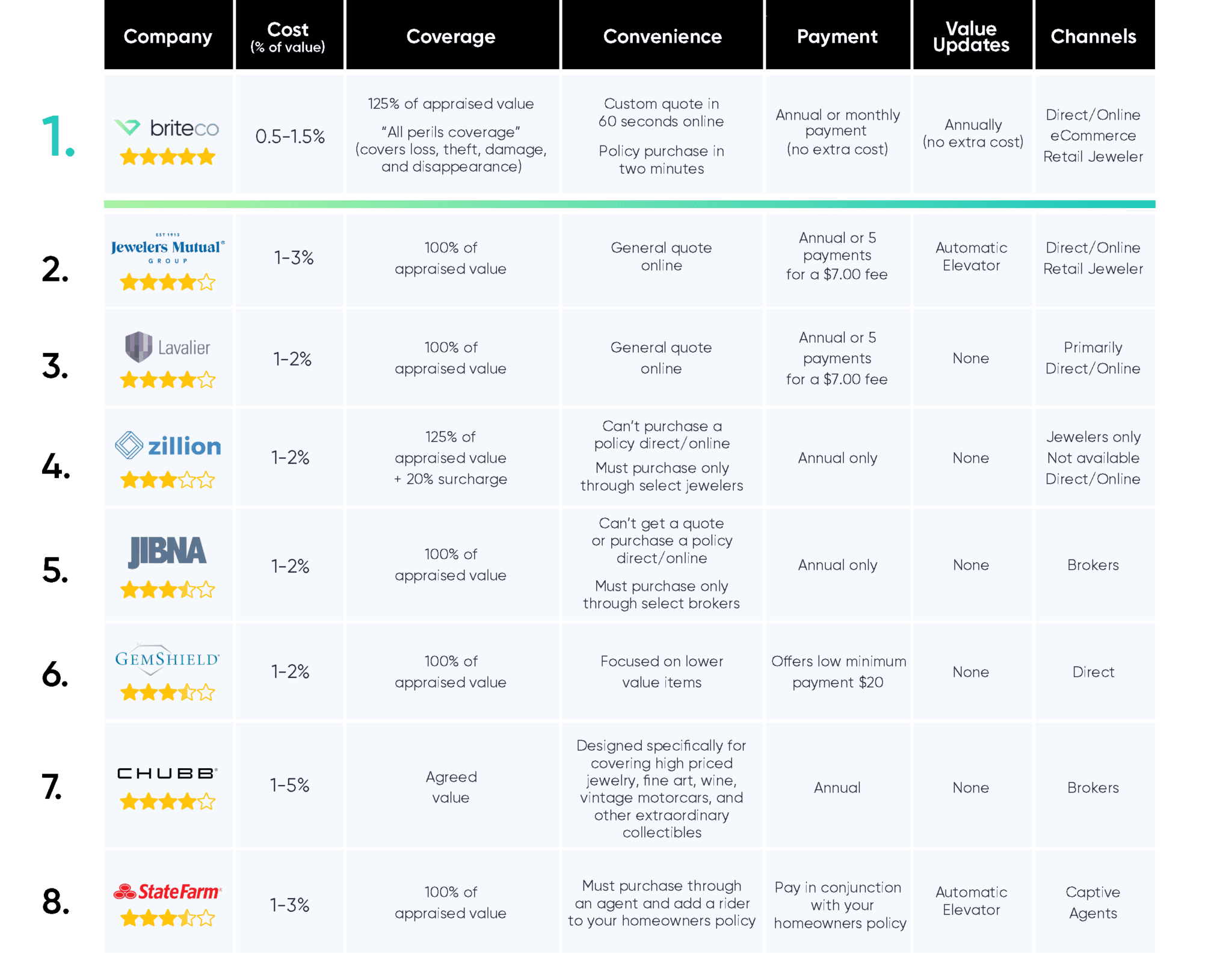

Top Jewelry Insurance Companies

While the best jewelry insurance provider ultimately depends on individual needs and preferences, here are some leading companies known for their comprehensive coverage, competitive rates, and customer service:

1. Jewelers Mutual Insurance Company:

- Specialization: A dedicated provider specializing exclusively in jewelry insurance.

- Coverage: Offers a wide range of coverage options, including all-risk, named perils, and specific perils.

- Valuation: Accepts appraisals from certified gemologists and offers agreed value options.

- Reputation: Known for its strong financial stability, excellent customer service, and efficient claims processing.

2. Chubb Insurance:

- Specialization: A global insurer with a strong reputation for high-net-worth individuals and families.

- Coverage: Provides comprehensive coverage for jewelry, including theft, damage, and loss.

- Valuation: Accepts appraisals from certified gemologists and offers agreed value options.

- Reputation: Known for its personalized service, financial strength, and expertise in handling high-value claims.

3. AIG Private Client Group:

- Specialization: Offers insurance for a wide range of personal assets, including jewelry.

- Coverage: Provides comprehensive coverage for jewelry, including theft, damage, and loss.

- Valuation: Accepts appraisals from certified gemologists and offers agreed value options.

- Reputation: Known for its global reach, financial stability, and expertise in handling complex claims.

4. Hiscox:

- Specialization: A specialist insurer for high-value assets, including jewelry.

- Coverage: Offers comprehensive coverage for jewelry, including theft, damage, and loss.

- Valuation: Accepts appraisals from certified gemologists and offers agreed value options.

- Reputation: Known for its innovative approach to insurance, competitive rates, and focus on customer satisfaction.

5. Travelers Insurance:

- Specialization: A major insurance provider with a wide range of personal insurance products, including jewelry insurance.

- Coverage: Offers comprehensive coverage for jewelry, including theft, damage, and loss.

- Valuation: Accepts appraisals from certified gemologists and offers agreed value options.

- Reputation: Known for its financial stability, nationwide network, and strong customer service.

FAQs About Jewelry Insurance

1. What is the cost of jewelry insurance?

The cost of jewelry insurance varies depending on the value of your jewelry, coverage options, and deductible. It’s advisable to obtain quotes from multiple providers to compare premiums.

2. Does jewelry insurance cover lost or damaged earrings?

Yes, jewelry insurance typically covers lost or damaged earrings, but it’s essential to check the policy details for any specific exclusions.

3. Can I insure jewelry I inherited?

Yes, you can typically insure inherited jewelry, but you may need to provide proof of ownership and an appraisal.

4. Is jewelry insurance worth it?

The decision to purchase jewelry insurance is a personal one. If your jewelry represents a significant financial investment or holds sentimental value, insurance can provide peace of mind and financial protection.

5. How do I file a claim for jewelry insurance?

The claims process varies depending on the insurance provider. Generally, you’ll need to report the loss or damage, provide documentation, and cooperate with the insurer’s investigation.

Tips for Protecting Your Jewelry

Beyond insurance, proactive measures can significantly reduce the risk of loss or damage to your jewelry:

- Secure Storage: Store valuable jewelry in a safe deposit box or a secure safe at home.

- Travel Precautions: When traveling, avoid wearing expensive jewelry or carrying it in easily accessible bags.

- Regular Cleaning: Regular cleaning and maintenance can help prevent damage and maintain the brilliance of your jewelry.

- Proper Handling: Handle jewelry with care, avoiding dropping or bumping it against hard surfaces.

- Appraisals: Obtain professional appraisals for valuable pieces to establish their market value.

Conclusion

Jewelry insurance is a crucial investment in safeguarding your precious possessions. By understanding the importance of coverage, carefully considering provider options, and taking preventive measures, you can ensure your cherished pieces are protected from unforeseen events. Remember, the right insurance provider can provide peace of mind, financial security, and the ability to preserve your treasured jewelry for generations to come.

![5 Best Jewelry Insurance Companies [2024] Ryan Hart](https://www.ryanhart.org/img/B220132-P01.jpg)

:max_bytes(150000):strip_icc()/LAvalier-9f8a30ff759244cf82635f899dc759e8.png)

![5 Best Jewelry Insurance Companies [2024] Ryan Hart](https://www.ryanhart.org/img/B220132-HB01.jpg)

:max_bytes(150000):strip_icc()/GemShield-049399c9fd3e4ed1ab84ca1b40b934ea.png)

:max_bytes(150000):strip_icc()/JM-Main-Image-127f9b02e2f04b1e8bdcae542178366c.jpg)

Closure

Thus, we hope this article has provided valuable insights into Safeguarding Your Sparkle: A Guide to the Best Jewelry Insurance Companies. We hope you find this article informative and beneficial. See you in our next article!